Financial training programs emerge as a pivotal factor in shaping the careers of finance professionals, offering a pathway to enhanced knowledge, skill development, and many career advancement opportunities. This comprehensive exploration delves into the myriad ways financial training can revolutionize your professional journey, highlighting the significance of these programs in the ever-evolving landscape of business finance.

The Essence of Financial Training for Career Advancement

- Building a Strong Knowledge Base: A robust understanding of financial concepts, tools, and strategies is crucial for making informed decisions and effectively navigating the complexities of the financial sector

- .Keeping Pace with Industry Evolution: The finance sector is characterized by its rapid evolution, with frequent updates in regulations, technologies, and methodologies. Financial training programs ensure that professionals stay abreast of these changes, maintaining their relevance and competitiveness in the field.

- Unlocking New Career Pathways: Investment in financial training is synonymous with investing in one’s career growth. It opens doors to higher-level positions and diverse job opportunities, showcasing a commitment to personal and professional development.

- Expanding Professional Networks: These programs often serve as a platform for networking, connecting you with peers, industry experts, and mentors. Such networks are invaluable for gaining new insights and opportunities within the finance sector.

The Tangible Benefits of Financial Training Programs

- Boosted Confidence: Financial training instils a sense of confidence in professionals, enhancing their decision-making and problem-solving abilities.

- Enhanced Career Prospects and Earnings: Specialized training in finance often correlates with better job prospects and higher salaries. The skills and qualifications gained through these programs make you a desirable candidate for roles demanding greater responsibility and offering better remuneration.

- Adaptability in Diverse Roles: The transferable skills acquired through financial training allow versatility in career choices within the finance industry, equipping you to confidently tackle new challenges.

- Commitment to Continuous Learning: The dynamic nature of finance necessitates ongoing education. Financial training programs lay the groundwork for lifelong learning, encouraging further certifications and engagement with industry developments.

Exploring the Landscape of Financial Training Programs

Financial training programs come in various formats, catering to different learning needs and career objectives. These include certification programs, professional development courses, and specialized workshops, each offering unique benefits and learning experiences.

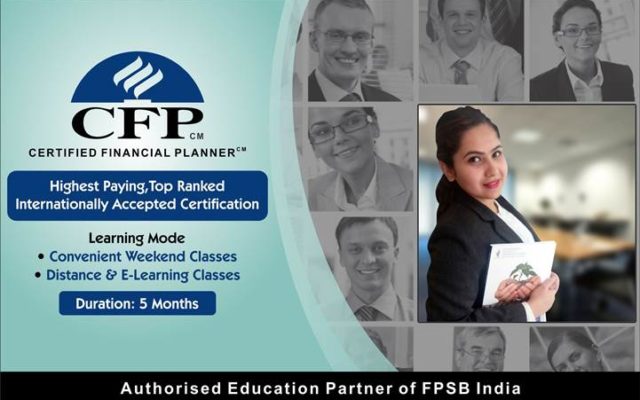

- Certification Programs: These structured programs provide in-depth knowledge in specific finance areas and are often recognized by professional bodies, enhancing your professional credibility.

- Professional Development Courses: These courses are customized to update or expand your knowledge, focusing on the latest trends and practices in the finance sector.

- Specialized Workshops: Workshops offer practical, hands-on experience in specific areas of finance, ideal for those looking to gain specific skills in a short time frame.

Key Competencies Gained from Financial Training

Financial training programs encompass various skills and knowledge areas crucial for financial industry success. These include:

- Financial Analysis and Reporting: Essential for roles such as financial analysts and accountants, these skills involve interpreting financial data and generating insightful reports.

- Risk Management and Compliance: Vital for risk management and audit professionals, this area focuses on identifying and mitigating risks while ensuring regulatory compliance.

- Investment and Portfolio Management: Crucial for asset and wealth managers, these skills involve understanding investing principles, portfolio construction, and risk-return analysis.

Selecting the Right Financial Training Program

Choosing the most suitable financial training program requires careful consideration of your career goals, the accreditation of the program, and practical aspects such as time and cost.

- Assessing Your Goals and Needs: Identify the specific skills and knowledge you aim to acquire, aligning them with your career aspirations.

- Researching Accredited Programs: Look for programs with a strong reputation, qualified instructors, and a curriculum that meets industry standards.

- Considering Time and Cost Factors: Evaluate the program’s duration, flexibility, and financial investment, ensuring it aligns with your personal and professional commitments.

Note:

Financial training programs are a gateway to enhanced professional capabilities, increased marketability, and a wealth of new career opportunities. Whether at the outset of your career or seeking to elevate your professional standing, these programs offer the tools and knowledge necessary to thrive in the fast-paced world of business finance. Investing in your professional development through financial training will enrich your skillset and set the road ahead for a successful career path in the modern finance business.

Enroll at International College of Financial Planning (ICOFP)

The International College of Financial Planning (ICOFP) is renowned for its specialized focus on financial planning and wealth management education. This specialization makes it an ideal choice for students aiming to excel in these fields. ICOFP’s curriculum is designed to align with the latest industry standards and practices, ensuring that students receive an education that is both current and practical.

Moreover, our institution boasts experienced faculty members who are experts in their respective fields. This allows students to learn from professionals with real-world experience, enhancing the practicality of their education. Networking opportunities with industry professionals and alums could be another significant advantage, offering students a platform to build connections that benefit their future careers.

Additionally, ICOFP offers a range of courses ranging from beginners to seasoned professionals looking to update their skills. Modern teaching methodologies, including case studies, simulations, and interactive sessions, could enrich the learning experience.

The International College of Financial Planning stands out for its specialized focus, experienced faculty, industry-aligned curriculum, networking opportunities, and modern teaching methodologies, making it a top choice for students pursuing a career in financial planning and wealth management.